SAP New IDC Study: When Will IoT Be Mainstream in Your Industry?

For Oliver Edinger, SAP’s head of IoT and Industry 4.0 in Germany, things are only getting started.

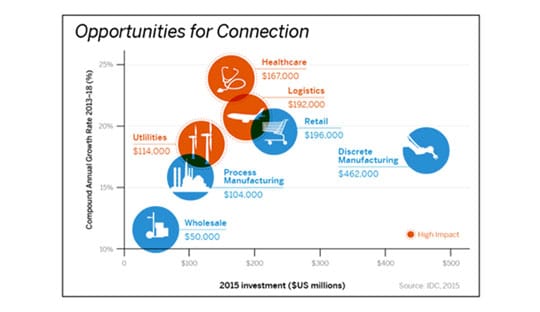

Last year, discrete manufacturing turned out to be the main driving force behind the growth of the IoT. A recent study by the market research firm IDC found that these manufacturers spent by far the most on integrating their machines and other assets, followed by retailers, logistics companies, and organizations in the health sector. Because 2016 will be the year in which the number of manufacturing factories that have implemented a basis for IoT will surpass those that haven’t, IDC is already calling this technology “mainstream.”

Will IoT soon be mainstream in your industry?

“Solid Understanding” of the IoT in Discrete Manufacturing

Oliver Edinger, SAP’s director of IoT and Industry 4.0 in Germany, agrees that this industry has definitely acquired a “solid understanding” of these innovations. Whether in optimizing manufacturing processes, reducing scrap, implementing lot sizes of one in mass production, monitoring energy consumption, or collecting data on overall equipment effectiveness (OEE), IoT gives manufacturers a more efficient means of handling many common tasks.

IoT doesn’t begin and end with the production floor, however. In warehouse and transport logistics, those in manufacturing need to have spare parts and components available, as well as the ability to deliver finished products to customers as quickly as possible. “Before they have trucks pull up to a loading ramp, companies need to be sure that the right items are ready to go so they don’t waste time waiting,” Edinger explains. “Transparency with regard to what’s going to be where and when – a truck’s actual arrival time in a loading zone, for example – is essential.” When the entire chain of supply and delivery companies is integrated, customers can simply consult their preferred online device to find out how long it will be before they receive the items they ordered.

Edinger believes that this type of comprehensive interconnectivity will eventually be “crucial to ensuring customer satisfaction.” At the same time, he is convinced that peak IoT innovation won’t be reached until companies start offering intelligent products, services begin to constantly optimize themselves based on product data, and customers can receive more information on the operational condition they can expect products to be in. Realigning a business model to the outcome-based economy – where customers pay for services, not products – is also often impossible without IoT.

One in Three Companies Under Pressure from Disruptive Technologies

Companies in manufacturing serve as an example of how IoT affects not just core processes, but entire organizations. Indeed, IDC projects that one in every three companies will face pressure from digitally minded competitors within the next three years. While the ways in which disruptive technologies will evolve is more difficult to predict, IoT is sure to play a prominent role. Last year, for instance, nearly 60% of the decision makers surveyed by IDC were already convinced that IoT will be strategically important to their business, while almost one in four believed in its significant potential to effect change.

IoT Costs Declining, but the Plunge is Yet to Come

As IDC’s “mainstream timeline” shows, not every industry is evolving at the same pace. Consumer products represent the second sector where use of IoT is expected to become commonplace, likely within the next two years. At the moment, the costs involved in integrating products and consumers are still too high in many cases. “There’s no point in selling a ‘smart’ sneaker for €130 if the technology that goes into it costs €10 per year,” Edinger explains with regard to what experts call the “cost digression curve.” Here, adding IoT functionality to more and more products results in an increasingly favorable cost-benefit ratio. The sharp decline in the price of sensors has already demonstrated the effect of significant demand. “The big drop in the costs involved in the Internet of Things is still on its way,” Edinger reports.

Meanwhile, the retail sector is even more sensitive to these prices. “Since they operate in an industry known for its narrow profit margins, retail companies think more than twice about where to invest,” Edinger says. Many supermarkets in France have already moved to electronic product labels. Upon entering a store, customers can bring up a digital shopping list designed to help them find items and provide information on special offers. Using triangulation (based on a shopping cart transmitter or a smartphone app, for instance), retailers can gather information on where customers are, where they linger, and the products they tend to ignore. Most of these projects are pilots, however, hence IDC’s prediction that the IoT won’t see widespread use in the retail industry until 2020.

IoT Projected to Go Mainstream in Healthcare in 2020

According to IDC, the healthcare sector will also need another four years before a majority of companies implement IoT functionality. In this case, however, Edinger attributes this less to the question of cost and more to the fact that the industry is subject to considerable regulation. Each and every solution has to meet an array of local laws and guidelines: Germany has its own specific legislation on medical products, for example, and the U.S. Food and Drug Administration (FDA) has to approve all new offerings before they hit the market. The corresponding inspections take time, but they are also showing doctors and patients that IoT technology makes sense in connection with specific medical indications. “Using smartphone apps and an IoT platform, those suffering from chronic illnesses can monitor their vital signs and share them with their doctor,” Edinger reveals. “There’s a lot of potential in personalized and outcome-based healthcare.” In carrying out a corresponding project for diabetes patients in Germany, SAP and Roche truly showed that they have their fingers on the current pulse.

Комментарии