AfDB issues 1.000% US $1.0 Billion Benchmark due 15 May 2019

OREANDA-NEWS. On Thursday, April 14, 2016, the African Development Bank (“AfDB”), rated Aaa (Moody’s) / AAA (S&P) / AAA (Fitch), launched and priced a new USD 1 billion 3-year Global benchmark transaction due 15 May 2019.

The new 3-year issue is AfDB’s second USD Global benchmark this year, and follows on from a successful USD 1 billion 3-year Global benchmark transaction priced in February, which had tightened significantly in the secondary market.

Given the constructive market backdrop for issuance and a clear execution window, a USD 1 billion “no grow” transaction was announced on Wednesday, April 13, 2016 at 2:30 pm London time and initial price thoughts of midswaps +14 basis points area were simultaneously released to the market.

Demand grew rapidly overnight and with indications of interest in excess of USD 1.2 billion, the books were officially opened in the morning of the following day at 8:45 am London time, with a price guidance of midswaps +14 basis points area, in line with initial pricing thoughts.

The order book grew steadily during the morning session, with demand exceeding USD 1.6 billion by 12 pm London time, thereby allowing the AfDB to subsequently tighten guidance and set the spread 1 basis point tighter at midswaps +13 basis points.

Joint Lead Managers on the transaction were BMO Capital Markets, BAML, Goldman Sachs International and TD Securities. Mizuho Securities and SMBC Nikko were co-leads on the transaction.

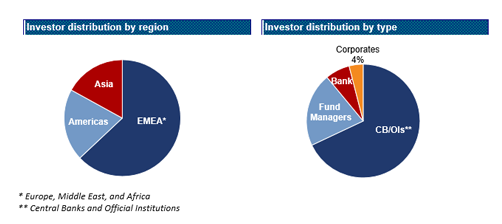

The AfDB is rated triple-A by all major credit rating agencies including Fitch, Japan Credit Rating Agency, Moody’s, and Standard & Poor’s. The new USD 1 billion global benchmark transaction demonstrates the loyal following the Bank benefits from in the international capital markets.

Комментарии